Arthur Ravenel Jr. Bridge

Charleston, United States

Bridging the gap between Wall Street and Main Street

Essex offers a boutique investment banking platform with a proven track record of delivering innovative capital solutions for clients.

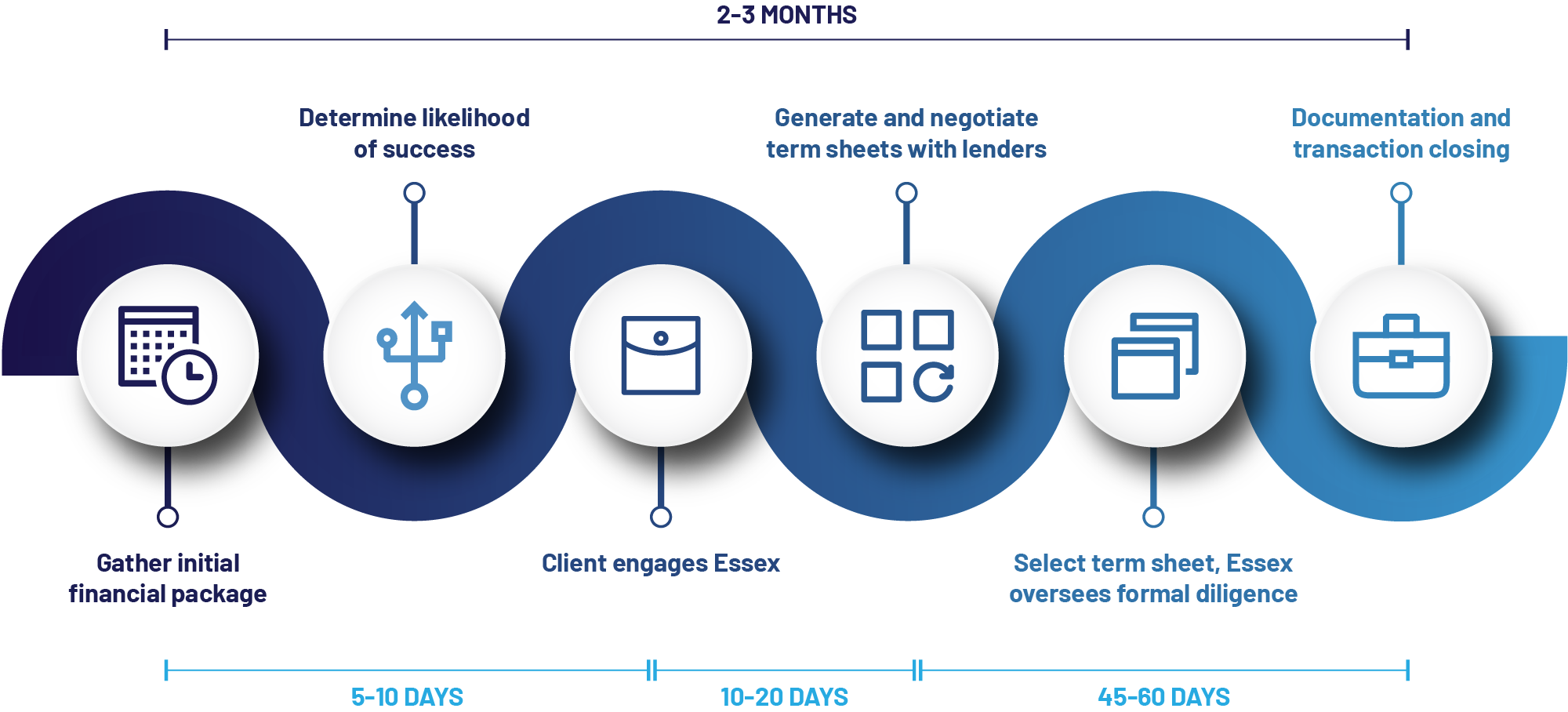

Our Process

Essex has refined the debt capital raising process over twenty years of closing a diverse mix of transactions. Our extensive upfront diligence model lends itself to successful outcomes.

Every situation is unique, but a typical engagement timeline spans two to three months.

Types of Funding

Senior Debt

Collateral-based loans for operating businesses with varying credit quality

- AR/Inventory revolving lines of credit

- Equipment term debt

- Owner occupied real estate

- Investment properties

Types of Funding

“Unitranche” Debt

Cash flow-based debt for asset-light industries

- Collateral not required

- Term loans underwritten based on multiples of cash flow

- Revolvers also available

- Leverage available at 4 X EBITDA

- Limited amortization

- Often limited covenants and personal guarantees

Types of Funding

Subordinated Debt

Solutions for dividend recaps, acquisitions, and growth capital

- Cash flow based

- Term debt

- Junior in the capital structure to any Senior Debt

“

Bob and Rob are extraordinary professionals. Their detailed, thorough approach to understanding our unique business resulted in Essex delivering a very specific solution that met our financing needs to fuel our expansion. We view this relationship as an important partnership that will allow for Chrome’s continued growth for years to come.

PETER WASMER, CEO

CHROME CAPITAL

News & Insights